does california have estate or inheritance tax

Notably only Maryland has both. If you live in Oregon you can be happy that you dont have to pay both an estate tax and inheritance tax like people in Maryland.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up.

. California Legislators Repealed the State Inheritance Tax in 1981. The estate tax is paid out of the estate so the beneficiaries will not be liable for paying the estate tax technically speakingalthough it would deplete the amount left in the. California does not levy a gift tax.

California also does not have an inheritance tax. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. Like most US.

California previously did have what was called an inheritance tax which acted similar to an estate tax the primary. Iowa is phasing out its inheritance tax by reducing its rates by an additional 20 percent each year from the. States California doesnt have an inheritance tax meaning that if youre a beneficiary you wont have to pay tax on your inheritanceAnd even for the federal.

California does not have an estate tax so probate is generally spent verifying the validity of the will and confirming who will act as executor of the estate. Proposition 19 was approved by. However the federal gift tax does still apply to residents of.

The State Controllers Office Tax Administration Section administers the Estate Tax Inheritance Tax and Gift Tax programs for the State of California. Ad Inheritance and Estate Planning Guidance With Simple Pricing. The Economic Growth and Tax Relief.

In fact just six states do Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania. We have offices throughout California and we offer in-person phone and Zoom appointments. Twelve states and Washington DC.

The Oregon Estate Tax. For most individuals in California this is no. No California estate tax means you get to keep more of your inheritance.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. Californias newly passed Proposition 19 will likely have major tax consequences for individuals inheriting property from their parents. Individuals unrelated to a deceased person however tend to be subject to inheritance tax.

People who are starting the estate planning process often wonder about the potential estate or inheritance tax implications. We also offer a robust overall tax-planning service for high net-worth families. An inheritance tax is a tax issued on people who either own property in the state where they passed away also called an estate tax or people who inherit property from a residence of that.

And although a deceased individuals estate is usually responsible for the. On the other hand you. If you have additional questions or concerns about estate planning or estate taxes contact us at the Northern California Center for Estate Planning Elder Law by calling 916-437-3500 or by.

Taxes On Your Inheritance In California Albertson Davidson Llp

:max_bytes(150000):strip_icc()/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

How To Avoid Estate Taxes With A Trust

Inheritance Tax Here S Who Pays And In Which States Bankrate

States With No Estate Tax Or Inheritance Tax Plan Where You Die

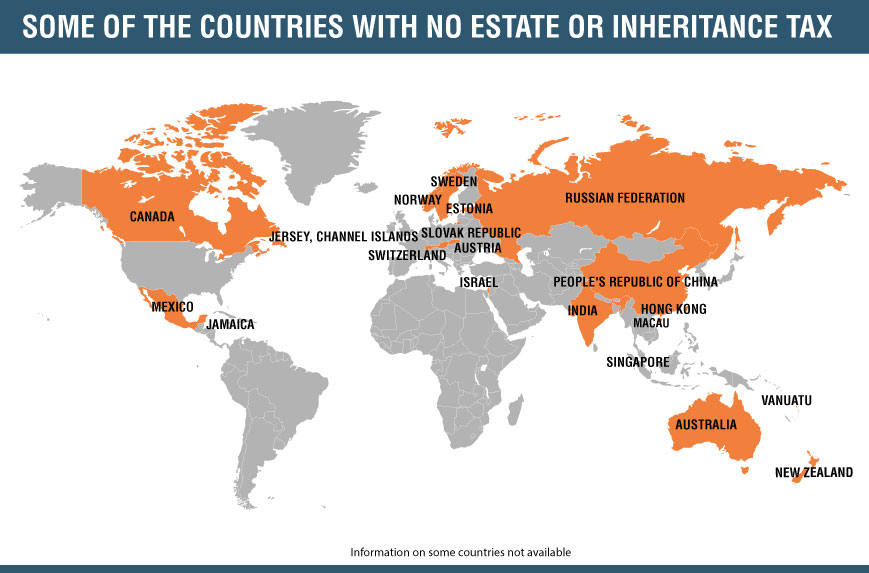

Countries With Or Without An Estate Or Inheritance Tax Policy And Taxation Group

2021 Real Estate Sales Person Exam Prep California Questions With Accurate Answers In 2022 Exam Prep Exam Real Estate Sales

How Is Tax Liability Calculated Common Tax Questions Answered

State Estate And Inheritance Taxes Itep

How Much Is Inheritance Tax Community Tax

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Top 4 Gift And Estate Tax Avoidance Strategies Estate Tax Estate Planning Estate Planning Attorney

Opportunities And Pitfalls For Foreign Inheritances And Beneficiaries Advisor S Edge

Federal Gift Tax Vs California Inheritance Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Is Inheritance Taxable In California California Trust Estate Probate Litigation

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Countries With Or Without An Estate Or Inheritance Tax Policy And Taxation Group

State By State Guide To Taxes On Retirees Inheritance Tax Estate Tax Purple States